We spend a lot of time talking up the benefits of real estate as an investment asset.

Real estate is tangible, physical property; it retains value over time and enjoys demand. Real estate investors can easily enhance their returns via the use of leverage. Whether an investor owns commercial or residential, real estate can generate returns via stable cash flows — not just appreciation.

It looks simple on paper: buy property, rent it out, manage it well, and take money to the bank.

However, buying, maintaining, and managing a building —requires work. For investors who are unprepared to make deal sourcing and property management their full time job, REITs are a viable option.

As a vertically integrated private real estate investment company, it’s no surprise that we think private equity represents a strong alternate option for investors who prefer to delegate acquisitions, management, and maintenance to professionals.

But, for non-accredited investors, investors who prefer greater liquidity, or those who appreciate the diversification afforded by large real estate portfolios, real estate investment trusts (REITs) can provide compelling access to high-value properties with minimal complexity.

Allow us to present an introduction to REITs: what they are, how they work, and some terms new investors should be familiar with.

What is a REIT?

Real estate investment trusts (REITs) are companies that own or finance real estate assets, and make ownership shares available to investors. In order to hold the classification as such, REITs are are required by US law to distribute at least 90% of their taxable income as shareholder dividends.

What are the different types of REITs?

What are the different types of REITs?

REITs come in a few different flavors. One classification involves the type of assets in which a REIT invests.

1. Equity REITs are the most common, and the most straightforward. They acquire, own, lease property, and distribute the income along to shareholders. Equity REITs might operate a wide variety of property types, or they may be more specialized, opting to focus on only particular real estate asset classes (e.g., an all Class-A Office REIT).

2. Mortgage REITs (or mREITs) do not own property. Instead, they originate or purchase mortgages and/or mortgage-backed securities, providing financing solutions for other real estate investors, and earn returns on interest.

3. Hybrid REITs hold both properties and mortgages.

Regardless of the particular real estate assets in which they invest, REITs can also be defined according to how shares are bought and sold.

1. Exchange-traded REITs: these are public corporations whose business is real estate investing. Investors can simply buy shares of publicly-traded REITs on a stock exchange.

2. Public Non-Traded REITs. These are public, but non-listed REITs PNLRs), meaning that they’re registered with the SEC, but not available on national stock exchanges.

3. Private Non-Traded REITs: Unavailable on stock exchanges and exempt from SEC regulation. These investment opportunities are only available to institutional investors and accredited investors.

While exchange-traded REITs can be bought and sold on ordinary stock exchanges, investors also buy into real estate ETFs or open-end mutual funds to diversify their REIT investments.

REIT Terms Every Investor Should Know

Some conceptual crossover from REITs and private equity funds exists. Concepts like appreciation and depreciation, amortization, cap rate, cash flow, cost of capital, interest, internal rate of return, leverage, and return metrics are always worth learning more about, but they’re not specific to the REITs side of real estate investing.

On the other side of the coin, because REITs operate by selling stock to shareholders, some financial concepts from that world are also relevant and important, like market cap, net asset value, debt-to-equity ratio, equitization, and securitization.

But, REITs have their own constellation of sometimes-confusing terms and acronyms.. Important proviso: some REITs calculate some of these items differently, and investors should always perform their own due diligence.

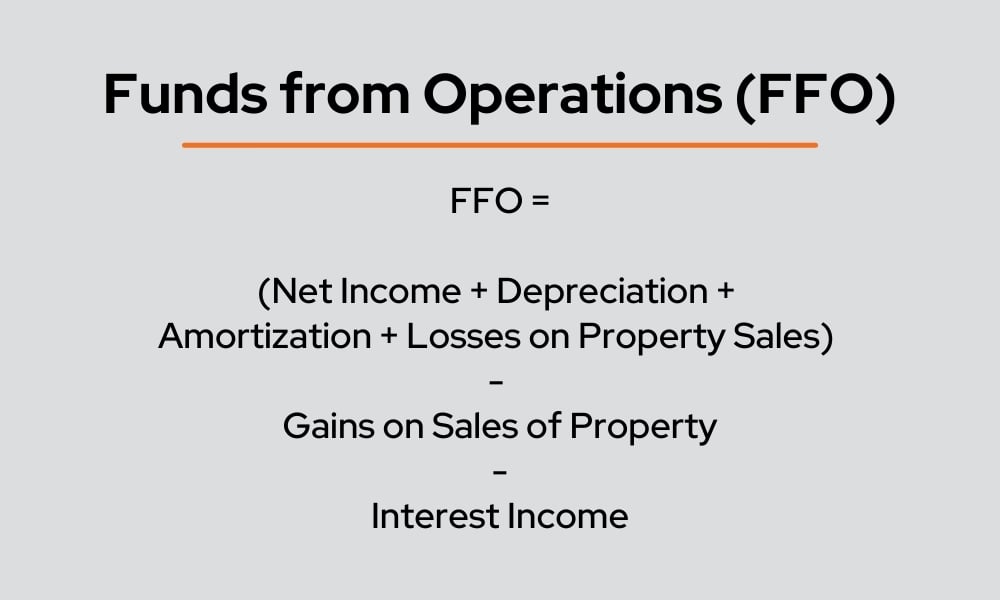

1. Funds From Operations (FFO): evaluates cash flow. Where for a publicly-traded company that isn’t a REIT, investors may look to a metric like earnings-per-share, REITs use FFO as a barometer for operating performance because it accounts for real estate-specific considerations, like depreciation. Here’s how you calculate it:

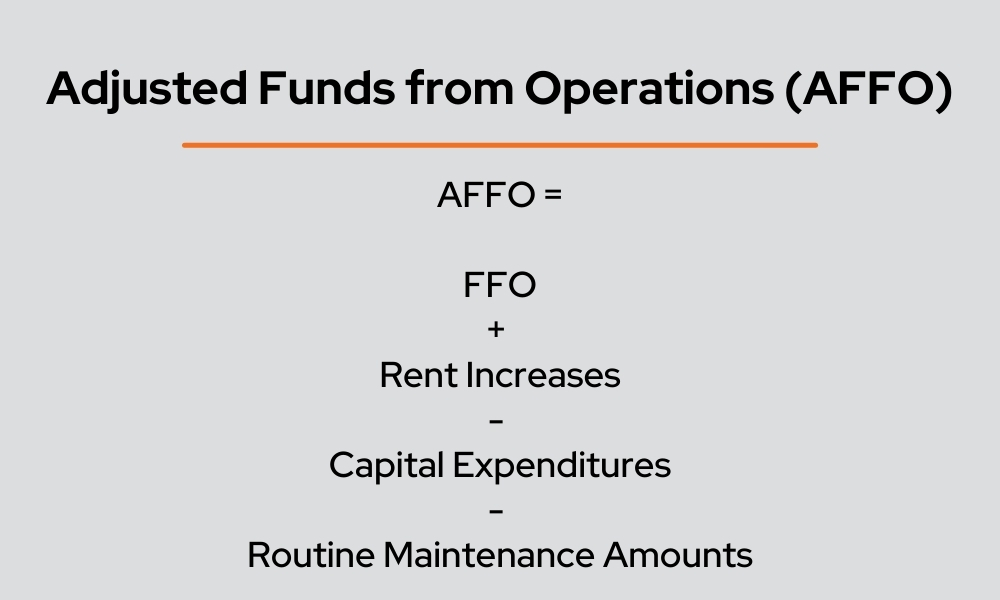

2. Adjusted Funds From Operations (AFFO) begins with the FFO formula and adjusts for recurring expenditures (CAPEX) used to maintain the portfolio.

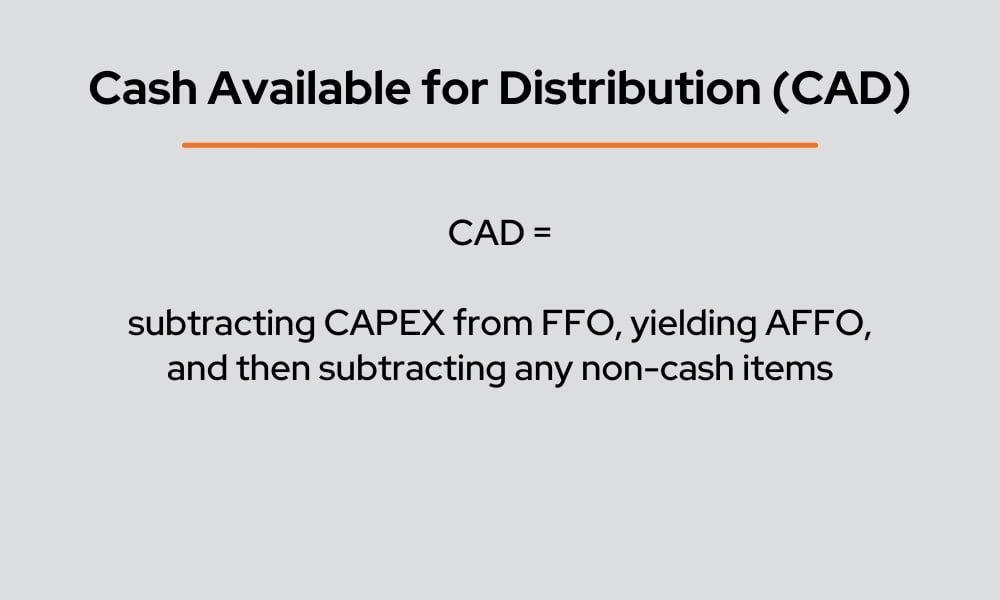

3. Cash Available for Distribution (CAD) (or FAD, replacing ‘cash’ with ‘funds’): the amount of on-hand cash available for distribution as shareholder dividends.

4. Net Operating Income(NOI) often referred to by REITs as EBITDA, short for “earnings before interest, taxes, depreciation, and amortization.” A REIT’s debt-to-EBITDA ratio is commonly used as a measure of its indebtedness; higher ratios typically imply more aggressively-leveraged strategies.

5. UPREIT and DownREIT: corporate structures used by REITs, usually to minimize capital gains tax liability.

- An UPREIT is an umbrella partnership REIT. This REIT structure allows property owners to exchange property for shares in the UPREIT,deferring capital gains tax on the said property. In an UPREIT, property owners trade their property in Section 721 exchanges for operating partnership units, which track with share prices but are not readily liquidated, to avoid creating taxable sale events. This is a wonderful strategy for property owners to divest of property and acquire ownership in a diversified portfolio while avoiding a capital gains tax burden.

- A DownREIT, as opposed to an operating partnership, is a joint venture between property owners. Unlike an UPREIT, a DownREIT actually owns and operates the properties in question. DownREITs can be complex and varied, but often create tax advantages by a process in which investors exchange their property for put options which can be converted into shares in the REIT.

6. Total Return: evaluates dividend-bearing investments, like REIT shares. While dividends are an important component of investor returns, dividends aren’t the complete return picture; the value of the share itself can also increase during the hold period, and Total Return is equal to the sum of both dividends issues and share price increase.

Concluding Thoughts

REITs come with advantages and disadvantages as opposed to other avenues for real estate investors, but for non-accredited investors who don’t wish to use a crowdfunding service, who value the additional peace of mind that comes with an SEC registered offering, and who aren’t prepared to purchase and manage their own buildings, REITs offer an unparalleled opportunity for exposure to real assets.

But, like we wrote above, because investment in a REIT involves not only purchasing and managing real estate, but also considerations that private equity doesn’t — like share price and dividends — understanding the appropriate terminology is critical for any interested investor.

Of course, this guide only skims the surface when defining terms every investor should know when investing with REITs. . The good news: we’re working on a couple of deeper dives, so check back here for more throughout the rest of the year.